Intuit 1099 Efile Service

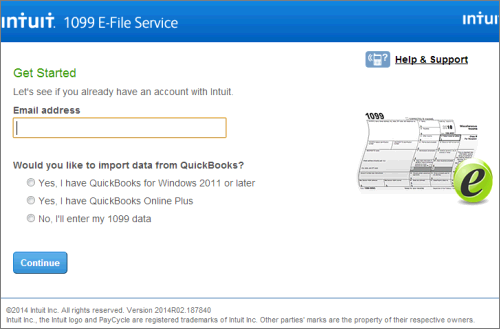

Company Enter your phone number email or user ID. Yes you can file your 1099s using the 1099 E-File Service account youve created.

View W3 Quickbooks Without Payroll Service In 2021 Payroll Taxes Payroll Quickbooks Online

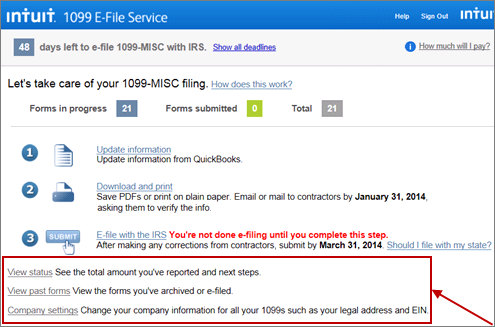

From here you can securely e-file to the IRS.

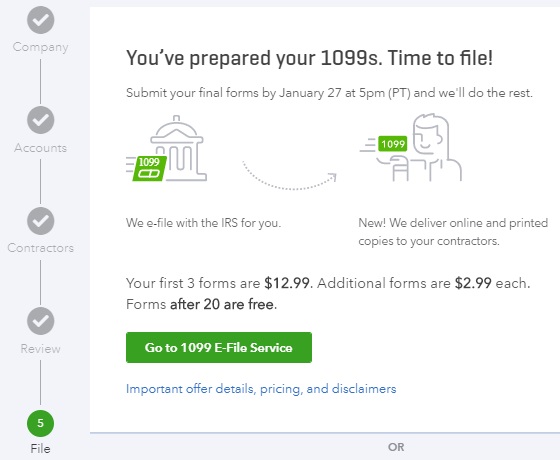

Intuit 1099 efile service. Forms beyond 20 are free. You can reach our Customer Support for 1099 E-File Service through chat by going to this link. Additional forms 399 each.

After preparing your 1099s select the E-File for me option. Anyone else having trouble with the 1099 e-file Service. Youll have to enter your 1099 data manually then print or email copies to your contractors.

Make sure you arent using any browser plugins that could interfere with secure sign. Service for IRS 1099 forms. Now that youve prepared and verified that the information is correct on your 1099s its time to e-file.

Every payment approved will show as a separate charge on your bankaccount statement and will not be combined as one charge. Select E-File for me to e-file your 1099s. Starting in January we will re-open the 1099.

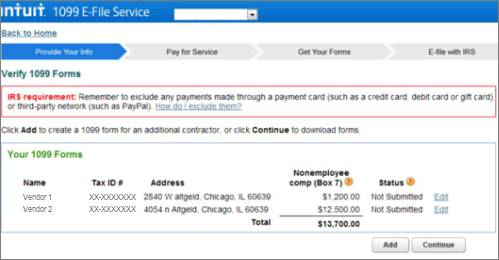

11 Intuit Proprietary Confidential 1099 E-File QBOQBFSP QBFSP customers have to generate and file their 1099-MISC forms Intuit does not file for them QuickBooks Online Plus customers can use our 1099 E-File Service to import data from QBO and then E-File through our service o This includes QBO QBOP QBFSP customers. You will be prompted to enter your billing information in the process of e-filing your forms and approve each payment. Verify your 1099 Forms then select Continue.

File a 1099 online in 3 easy steps - Intuit 1099 E-File Service. You can easily E-file your 1099s with QuickBooks. The Intuit 1099-MISC E-File Service is an easy low-cost and fast way for small business owners and small business accounting professionals to create print and electronically file 1099-MISC forms.

Im always here if you need more help logging in to your account. If you e-filed using the Intuit 1099 E-File Service the prior tax year and plan to file for the same vendors again you can update vendor information by following these steps. Us-public-prd-usw2-eks-qbopayroll-iopapp-ff9bf7bd7-t5b7k Intuit Inc the Intuit logo and PayCycle.

Or select Ill file myself to print and mail the forms yourself. A list of vendors. This affects QuickBooks 2014 2015 2016 and 2017.

Hmm that didnt work Heres what we can do. You can view or print copies anytime. All-inclusive service starting at 350 per recipient.

We need to make sure youre not a robot Complete the below challenge then select continue to sign in. If you use our paid one-time service or sign up for a monthly payroll subscription we will auto-populate the correct forms and file them with the IRS for you. Select Enter Information on the 1099 E-File main page.

It just says Please wait while we load the 1099 E-File Service and just sits there and does nothing. Sign in to your Intuit account to access all our products including Payroll. If you plan on mailing in a 1099 you must order a hard copy.

You can create and e-file up to 3 forms additional forms are 399 each. Well walk you through uploading your 1099 information to Tax1099 so you dont have to enter data twice. Starting with the 2016 2017 tax season the Intuit 1099 E-file service will not work with QuickBooks desktop anymore.

Heres more information on how to file 1099-MISC forms using e-file service standalone. It also pops up a menu saying youll need a new app to open this qbks2 link and to check the app store which finds nothing also. E-File Service for your 2021 1099 forms.

E-filing with Tax1099 is safe and easy Using the highest safety measures Tax1099 will e-file your 1099s for you. The service is closed for tax year 2020. They cannot be downloaded on the IRS.

Terms and conditions features support pricing and service options subject to change without notice. Billing or payment method for the 1099 E-File service is by credit card. Learn more about volume pricing.

Theyre available from 600 AM to 600 PM PST. This service is closed for tax year 2020. The new change is caused by the discontinuation of the Intuit Sync Manager utility back in March of 2016.

1499 Price includes 3 forms.

How Do I To Print 1099s Forms From Prior Year

Quickbooks Online Support Is Specialized Accounting Software Help You Run Your Business With Great Ease And Very Ea Quickbooks Online Quickbooks Online Support

E File 1099 Misc Quickbooks Quickbooks Online Data Services

File 1099 Misc Forms Using E File Service Standal

Quickbooks 1099 Nec Form Copy A Federal Discount Tax Forms

Quickbooks Error 15311 Explanation Reasons And Solution Quickbooks Solutions Quickbooks Payroll

Quickbooks 1099 Form Filing E File 1099 In Qb Pro Premier Payroll Enterprise

File 1099 Misc Forms Using E File Service Standal

Prepare And E File 940 941 Or 944 Electronically Quickbooks Payroll Payroll Taxes Quickbooks Payroll Quickbooks

Pin On Quickbooks Tutorial For Business Owners

File 1099 Misc Forms Using E File Service Standal

Easy 1099 E File With Quickbooks Online Nonprofit Accounting Academy

Is Anyone Else Having Trouble With Their Qbo Efile 1099 S

Hot App Of The Month Intuit 1099 E File Service

Post a Comment for "Intuit 1099 Efile Service"