Irs.gov Customer Service

According to the IRS website wait times average fifteen minutes in the months preceding the filing deadline January through April and average twenty-seven minutes in the months following the filing deadline May through December. 52 rows IRS Phone Number.

Offer In Compromise Faqs Internal Revenue Service

800-829-1040 for individuals who have questions about anything related to personal taxes available from 7 am.

Irs.gov customer service. Best Practices for Calling IRS Customer Service. The main IRS phone number is 800-829-1040. Paul area call the Taxpayer Advocate Service.

The Internal Revenue Service IRS administers and enforces US. The IRS is taking a holistic approach to taxpayer service that takes into consideration tax professionals in their dual roles as customers of IRS services and service providers to their clients taxpayers. Find the office you need to visit.

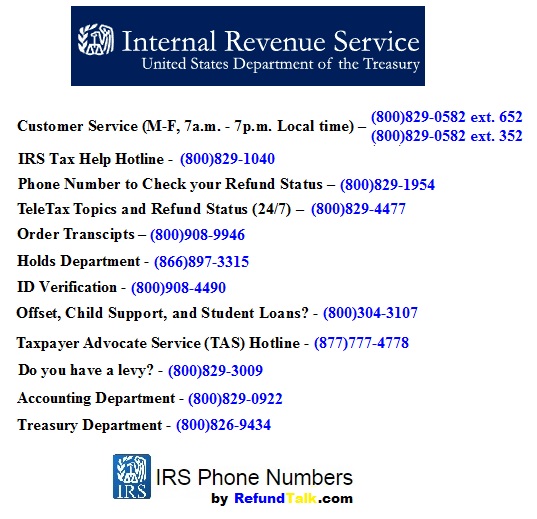

IRSs 800-829-0582 Customer Service Number This IRS phone number is ranked 7 out of 11 because 2306316 IRS customers tried our tools. Weve put together a list of IRS phone numbers that may come in handy to you below. Taxpayer Assistance Centers operate by appointment.

The IRS provides a few toll-free numbers to assist you depending on your circumstance. It is the practitioners first point of contact for assistance regarding their clients account related issues. Reschedule your appointment if you feel ill.

The IRS telephone number is 1-800-829-1040. This form is to be used for IRS Career Inquiries only. Get your refund status.

To visit your local Taxpayer Assistance Center you must. Calling the IRS verify that the number you have is correct. Help With Tax Questions.

Once youve set your language do NOT choose Option 1 regarding refund info. Practitioner Priority Service is a toll free account related service for all practioners nationwide. This service replaced the former Practitioner Hotline.

Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. IRS customer support which can be reached at 1-800-829-0922 is available Monday through Friday from 7AM to 7PM.

You can do this at IRSgov which is the only official website for the IRS. The IRSs efforts to develop a comprehensive customer service strategy seem promising. The IRS has multiple ways for taxpayers or concerned citizens to reach out to them.

Customer Service and Human Help The main IRS. Request that we temporarily. Meet your tax obligation in monthly installments by applying for a payment plan including installment agreement Find out if you qualify for an offer in compromise-- a way to settle your tax debt for less than the full amount.

Tax Reform Information and Services. 800-829-4933 for businesses with tax-related questions available from 7 am. Make an appointment by calling the appointment number for.

The first question the automated system will ask you is to choose your language. Choose option 2 for Personal Income Tax instead. Please do not use this form for tax or stimulus check inquiries.

Internal Revenue Service IRS Contact. How can I speak to a live person at the IRS. When you arrive wear a mask if youre not fully vaccinated and stay 6 feet away from others.

Unfortunately many individuals have fallen victim to scams perpetrated by dishonest people claiming to be IRS agents. Those inquiries must be addressed here. Tax Exempt and Government Entities TEGE 877-829-5500.

7 rows If you are in the MinneapolisSt. Call the Taxpayer Advocate Service at 202-803-9800 or 877-777-4778 See Publication. Contact the Internal Revenue Service.

Who Can I Claim As A Dependent Dependable Tax Rules I Can

Access Denied Income Tax Return Internal Revenue Service Tax Return

Https Www Irs Gov Pub Irs News Fs 08 07 Pdf

Pin On Accounting Finance Taxes

Refund Offsets Taxpayer Advocate Service

Pin On Calls To Action To Grow Your Audience

Irs Quietly Closing Offices During Covid 19 Crisis But Union Says It S Not Enough

Irs Phone Numbers Refundtalk Com

Access Denied Tax Guide Business Etsy Business

Do I Need To File A Tax Return Tax Return Tax Internal Revenue Service

Irs 1800 Phone Numbers How To Speak With A Live Irs Person Fast Irs How To Read Faster Network Marketing Tips

Access Denied Tax Return Tax Refund Tax Free

En Espanol Www Irs Gov Pub Irs Pdf P5027sp Pdf Irs Identity Theft Pub

Department Of The Treasury Internal Revenue Service Publication 15 Cat No 10000w Circular E Employer S Tax Guid Tax Guide Internal Revenue Service Payroll

Access Denied Irs Energy Efficiency Pub

Ir 2021 16 January 15 2021 The Internal Revenue Service Announced That The Nation S Tax Season Will Start In 2021 Internal Revenue Service Tax Season Filing Taxes

Federal Payroll Tax Form Payroll Taxes Payroll Tax Forms

Form2290 Com Irs Irs Gov Irs Forms

Post a Comment for "Irs.gov Customer Service"